|

We want to know what we can do to really help you build a business that has a predictable stream of profits, clients, referrals, and more. We want to provide you with the proper tools because this is not a "One Size Fits All" business for agents and advisors. It is also not a "One Size Fits All" financial world for the most aware group of consumers in history.

So, before I get to the meat of this writing, let's defuse a few myths…

Again, our focus has always been in the areas of marketing, research, and education. It might not sound too sexy, but that is what makes your world, and our world, go 'round. What are the things that keep you up at night regarding your business? Is it:

The good news is, with Ohlson Group, we have a commitment on each end. You will know what we expect of you and what you can expect of us. Call us at 877-844-0900 or schedule a 15 minute appointment with marketing consultants. We are looking to become the answer to those questions above. Some have said that I am trying to develop a "Modified Career Operation,” and you know, I like the sound of that. So, let's get going. Hope to hear from you! Until next time... good selling!

0 Comments

Do you know anyone that lost a spouse lately? I am sure that you do and I am sure they are re-working their plans. You should be there to help. Let's look at some of the challenges, opportunities and solutions:

Now, let's also take a look at the "tax time bomb.” The survivor has a good net worth and good financial products. The kids will now get all the dough when the survivor passes. When that happens, the kids can say good bye to low tax rates. This windfall will throw them into the higher brackets. What to do? A piece of paper and a drop of ink can transform lives, when the ink is used on a life insurance application. It’s simple: Start moving some of the assets into life insurance, so when death occurs, the money that is passed down is income tax free. That will pay for a lot more grandkids educations or assistance to heirs that have been behind a financial eight ball. But even though that will eliminate some tax rime bombs, let's don't forget about the survivors needs. The survivors life has changed forever. He/she will now be riding solo into retirement. He/she might not have desire to work as long. He/she might want accelerate retirement income. Should we begin meeting with the survivor again? You bet... because if you don't, someone else will. Here’s the bottom line… get with the survivor ASAP. Don't go in for a sales presentation, but a nice lunch at an appropriate time can ease some strain. Let the person know that you are there to help and there will be changes to his plan that need to be made. And, while you are at it, try to get a meeting with the attorney as documents will need to be re-written or altered. After the dust settles and the casseroles that friends and neighbors fixed are gone, the phone doesn't ring as much. Your client will have to "face the financial music.” Too many in this situation put it off for too long. Ask questions, re-write the plan, and everyone will gain. Until next time... good selling! I will make this commentary short, as I fear I am running out of time today. Why would that happen to me?

Well, I am confident that you have asked those same questions of yourself. Let me give you a statement from "The Best of Success," compiled by Wynn Davis. "Time can't be managed. But what can be managed are our activities and how we 'spend' time.” And all the experts agree... managing our activities begins with planning. So by knowing what's important for us - planning our work and working our plan, we become wise managers. Notice how everything revolves around having a plan? So, how can you monitor your time? Let's look… In "The Art of the Deal" by Donald Trump, he always had phone appointments and personal visits scheduled for 15 minutes. He informed the person on the other line that he had 15 minutes. Now, sure, if things are going great, you continue. But your plan should dictate what you do each day, into each week, into each month. You need to spend a part of each day prospecting. Yes... each day. You don't have any good prospects? Then you need to spend time on marketing, such as through your website, LinkedIn, Facebook, or planning quality content drips on your clients and prospects. Let's cut to the chase. At The Ohlson Group, we have many of these tools where we can help optimize your business. That is why we have to spend some quality time together... so together we can get your business even more successful than it is today. I hope that you have found this commentary to be of value to you. If so, and if you want to learn more, call us at 1-877-844-0900 or line up an appointment with one of our marketing consultants. If you don’t mind, I would like to close with a quote by Victor Hugo that I find helpful. "He who every morning plans the transactions of the day and follows out that plan, carries a thread that will guide him through the labyrinth of the most busy day.” Thanks for your time and until next time... good selling! Taking ownership and responsibility is a great deal in business, relationships and other aspects of life. If we want to make things better, it is our responsibility to do so. It reminds me of an old saying, "If it's meant to be, it is up to me.”

When our marketing consultants are making calls to contracted advisors and our good prospects, we often hear the same refrain. The answer comes after we ask if we can be of service, work up a case, assess or provide info. We often hear... "Nothing is cooking right now.” We then will ask, "When do you think you will have something cooking? Something where we can vie for the business?” Sometimes, they don't know. When we ask about their marketing plans, many don't have a plan nor do they have any budget towards it. When we ask how they feel about next year, many will speak of feelings of dread and fearing the ends of their careers. I am still scratching my head! We have the products that Americans need. We have a dwindling field force and most of the competition is in our minds. So, what should advisors with this attitude do? Simple, take responsibility. I recently read a quote by an unknown author regarding responsibility. "The power to fulfill our dreams is within each of us. We alone have the responsibility to shape our lives. When we understand this, we know that nothing, and no one, can deny us greatness. We are the ones pushing ourselves forward or holding ourselves back. The power to succeed or fail is ours alone.” Call me a simpleton, but that actually sums it up. I knew this from the time I started selling life insurance on a straight commission basis while in college. Talk about competition! There were agents on every corner. But I went to meetings, read motivational books, had a schedule, developed a regular prospecting program. Then I replicated this when I built an agency, and then later served as president of US life companies in America. It is simple, but hard. If this commentary is hitting you right between the ideas, don't feel as though you are alone. We have some answers. There are no quick fixes, but plans that have worked for hundreds of advisors and agents across America. If you want some solutions, please call us and speak to one of the marketing consultants. But, if you are not ready to take ownership and responsibility, then we wish you a happy retirement... for some an early retirement. I want to leave you with one other quote that I have always liked, by Ralph Waldo Emerson, "No one can cheat you out of ultimate success but yourselves." Thanks for your time and your business. Until next time... good selling! When asked this question, some people may feel as though they needed a change and aren't seeing the answers to the problem in the status quo. You see, we are asking this same question to agents and advisors across America, but we are prefacing that question with a few others.

How about we all take a look at the following questions before I ask you, "What do you have to lose?"

I could go on and on, but let me ask a couple other questions before I go in for the close...

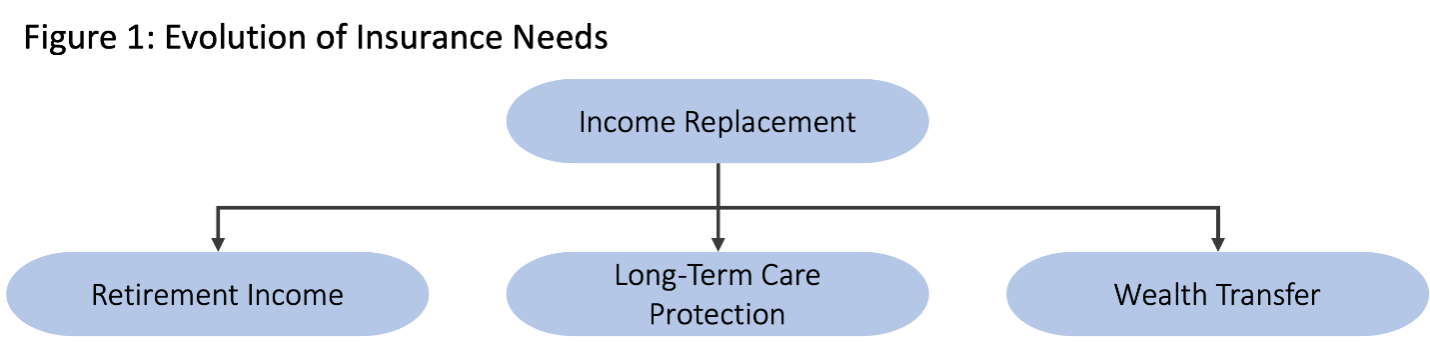

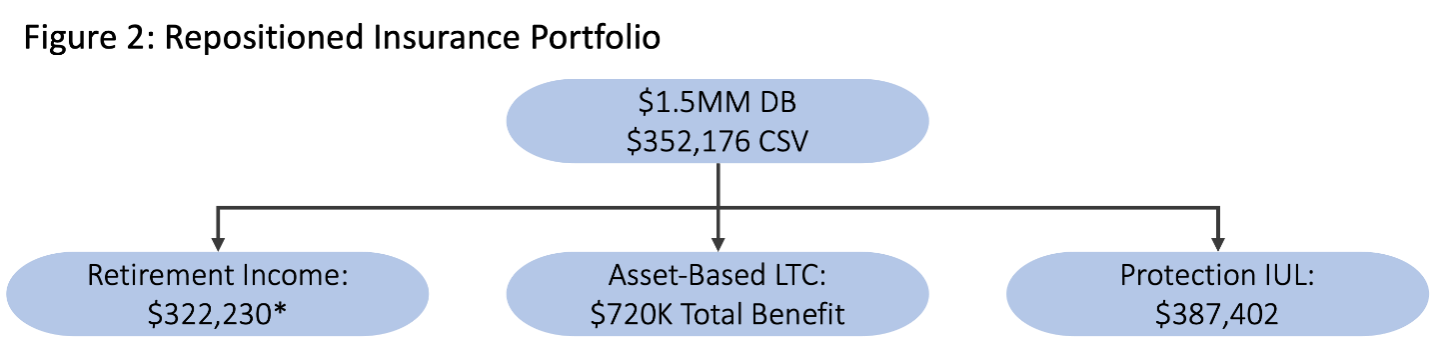

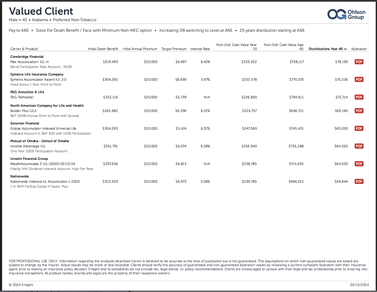

Okay, that was enough questions. If you are not lathered up by now... you never will be. But for those of you ready to make your business great again, I suggest you give us a call and have a 20 minute exploratory meeting with one of our marketing consultants. Let us show you what we have done for hundreds of agents and advisors across America. We have answers if you have the aptitude and the attitude. Okay, here it comes! Give us a call... "What do you have to lose?" except the potential for a lot more money and a lot more fun. Until next time... good selling! As clients age, they can find themselves in an enviable position: Their insurance assets have done what they were designed to do: Provide protection for their loved ones. In the process, they often amass significant policy cash value. As the client’s needs change, however, this insurance asset may not be flexible enough to meet their current needs. In most cases, client’s needs evolve from simple income replacement to a more diverse set of objectives as shown in Figure 1, below. The Challenge On the surface it seems rather simple: Reposition the cash value from the current insurance into new solutions that more closely match the client’s updated planning objectives. The reality is that there is no singular product that can accomplish all these objectives, and “splitting” the cash among multiple solutions typically involves a full surrender of the existing policy, triggering what can often be a rather sizable taxable event. The Solution Fortunately, there are a handful of insurance companies that offer “all seasons” product portfolios and the ability to “split” incoming 1035 exchanges upon receipt. This ability allows them to allocate funds to three separate solutions that can effectively transform the client’s insurance assets into a portfolio that matches their current needs far better than a single policy solution. In this instance, a 57-year-old male with a $1.5MM policy with $352,176 of surrender value was repositioned as shown in Figure 2, below. The total death benefit coverage inclusive of both the Protection IUL and Asset-Based LTC policy should the client not need care during their lifetime is $627,402 with no additional premium outlay. The annuity provides guaranteed income of over $322,000 over the client’s lifetime. If the client needs care and exhausts the LTC benefits, “total coverage” including income is $1,429,632. The contents of this document should not be considered as tax or legal advice. Any information or guidance provided is solely for educational or informational purposes and should not be relied upon as a substitute for professional advice. It is always recommended to consult with a licensed financial or legal advisor for specific guidance related to your individual situation. * Income begins at age 66, $10,741/yr guaranteed for 30 years Want More Life Sales Ideas?In today's digital age, our cell phones have become our lifelines, serving as the primary means of communication with friends, family, and businesses alike. With the convenience of smartphones and the demise of long-distance fees, many of us have forsaken traditional landlines in favor of the versatility of our mobile devices. As a result, we often retain our phone numbers even when relocating, sparing ourselves the hassle of updating contacts and notifying acquaintances. However, while the area codes of personal phone numbers hold little significance to us, the story takes a different turn in the realm of business phone numbers. 1. Establishing Trust and Familiarity Consumers frequently screen incoming calls, instinctively favoring those bearing local area codes. The inundation of spam, robocalls, and persistent telemarketers has cultivated a wariness of unfamiliar numbers. A local area code, however, serves as an immediate indicator of relevance, triggering recollections of past interactions with local businesses. This association fosters trust and familiarity, prompting a more receptive response from potential leads. 2. Enhancing Accessibility Despite the prevalence of virtual business transactions, the appeal of in-person assistance persists. A local phone number reassures customers that physical interaction remains an option if needed, instilling a sense of security from the initial outreach. Even if the area code does not precisely match their locale, a phone number with a state-specific area code can evoke a perception of locality, given the commonality of intrastate relocations. This perceived accessibility helps build trust and establish credibility of your business. 3. Cultivating Personal Connections Shared experiences and mutual understanding form the foundation of interpersonal connections. By aligning with local culture and customs, businesses wielding local phone numbers can easily exchange small talk… which honesty small talk is very underestimated. Discussions about traffic woes, upcoming festivals, or recent local news resonate deeply with customers, fostering a sense of camaraderie and mutual understanding of the community. These interactions nurture relationships to help both you and the lead develop a better understanding of one another. Three Paths to Acquiring a Local Phone Number

In Conclusion, Local Phone Numbers: Bridging Gaps and Boosting Sales The adoption of a local phone number can substantially increase contact ratios and foster meaningful connections with potential leads. Studies suggest that this simple yet impactful strategy can elevate contact ratios by up to 20% or more, translating to increased appointments and ultimately, higher sales figures. By leveraging the power of locality, businesses can carve out a niche in their communities, earning trust and loyalty one call at a time. Want More Prospecting Tips and Help?The conventional approach to designing accumulation-focused Indexed UL strategies involves minimizing the death benefit. Often, this is combined with using the maximum AG49 compliant illustrated rate to squeeze every dollar of projected income out of the product. While that can produce a compelling illustration, it may not be the most effective approach in the real world. That thought process is often the reason for things like stress testing or reducing the illustrative rate, even if it results in a reduced illustrative income. The truth is there is another, perhaps more meaningful alternative design that can deliver more consumer value from virtually any Indexed UL product. This more balanced approach to case design can deliver:

What's the Bottom Line?An additional $248,387 in coverage, an increase of over 61% versus a traditional design. The product includes a Chronic Illness ABR that is now based on a 61% larger face amount, putting more cash at the client’s fingertips when they need it most:

Over $14,000 in additional funding capacity per year. Remember, all the testing that limits how much premium you can contribute “rolls” forward. By the 10th policy year there is a whopping $140,000 of additional funding capacity. What's in it for the Advisor?As the face amount increases, so does the Target Premium. Using this consumer value packed approach increases Target Premium by 61%. What Products Work with this Approach?This strategy likely works with the majority of accumulation focused IUL products. Case design will be a manual process. Increasing the face amount from a maximum accumulation solve by 50% might be a good starting point. Need a hand creating illustration examples for your prospects? Contact the Life Department at Ohlson Group. We will help put your case together and provide supporting marketing material and case submission / and underwriting assistance. Download a Male 45, Preferred Non-Tobacco PDF Flyer |

Archives

July 2024

Categories |

Search Our Website to Find More Info, Tips, and Sales IdeasContact InformationOffice Address:

11611 N. Meridian Street | Ste 110 | Carmel, IN 46032 Phone: 1-877-844-0900 Fax: 317-844-4422 |

Quick Links |

THIS WEBSITE IS INTENDED FOR AGENT USE ONLY. NOT FOR USE BY CONSUMERS.

INFORMATION CONCERNING COPYRIGHT INFRINGEMENT CLAIMS

The Ohlson Group, Inc. provides links from its website to various third party sites which may enable you to obtain locations and information outside of The Ohlson Group's control. The Ohlson Group, Inc. neither controls nor endorses such other websites, nor have we reviewed or approved any content appearing on them. The Ohlson Group, Inc. does not assume any responsibility or liability for any materials available at these websites, or for the completeness, availability, accuracy, legality or decency of these sites.

CLAIMS OF COPYRIGHT INFRINGEMENT

The Digital Millennium Copyright Act of 1998, as amended, (the "DMCA") provides recourse for copyright owners who believe that material appearing on the Internet infringes their rights under U.S. copyright law. If you believe in good faith that materials we host infringe your copyright, you (or your agent) may send us a notice requesting that we remove the material or block access to it. If you believe in good faith that someone has wrongly filed a notice of copyright infringement against you, the DMCA permits you to send us a counter-notice. Notices and counter-notices must meet the then-current statutory requirements imposed by the DMCA; see http://www.loc.gov/copyright/ for details. Notices and counter-notices should be sent to [email protected]. The Ohlson Group, Inc., (877) 844-0900. We suggest that you consult your legal advisor before filing a notice or counter-notice. Also, please be aware that there are penalties for false claims under the DMCA.

The Ohlson Group Inc, and or Joseph R. Ohlson LUTCF is licensed to do business in all states except New York.

Privacy Policy

INFORMATION CONCERNING COPYRIGHT INFRINGEMENT CLAIMS

The Ohlson Group, Inc. provides links from its website to various third party sites which may enable you to obtain locations and information outside of The Ohlson Group's control. The Ohlson Group, Inc. neither controls nor endorses such other websites, nor have we reviewed or approved any content appearing on them. The Ohlson Group, Inc. does not assume any responsibility or liability for any materials available at these websites, or for the completeness, availability, accuracy, legality or decency of these sites.

CLAIMS OF COPYRIGHT INFRINGEMENT

The Digital Millennium Copyright Act of 1998, as amended, (the "DMCA") provides recourse for copyright owners who believe that material appearing on the Internet infringes their rights under U.S. copyright law. If you believe in good faith that materials we host infringe your copyright, you (or your agent) may send us a notice requesting that we remove the material or block access to it. If you believe in good faith that someone has wrongly filed a notice of copyright infringement against you, the DMCA permits you to send us a counter-notice. Notices and counter-notices must meet the then-current statutory requirements imposed by the DMCA; see http://www.loc.gov/copyright/ for details. Notices and counter-notices should be sent to [email protected]. The Ohlson Group, Inc., (877) 844-0900. We suggest that you consult your legal advisor before filing a notice or counter-notice. Also, please be aware that there are penalties for false claims under the DMCA.

The Ohlson Group Inc, and or Joseph R. Ohlson LUTCF is licensed to do business in all states except New York.

Privacy Policy

Copyright © 2024 The Ohlson Group, Inc. All Right Reserved.

RSS Feed

RSS Feed