|

Yes, I know that the MYGA (Multi Year Guarantee Annuity) market is hot. With the Fed steadily raising rates over the last year, the marketplace has seen an explosion in fixed annuity business. And with the inverted yield curve, the short term rates are even better than long term rates! Lastly, with the stock market being rocky, clients are flocking to guarantees. While all of this equals great returns for short-term planning for your clients, we shouldn’t lose focus on long-term goals. I’d like to re-introduce you to the “other" MYGAs. I’m talking about guaranteed lifetime withdrawal benefits, or income riders. In my opinion, right now is the perfect time to sell these GLWBs. The products give your clients GUARANTEED growth to the income account value and GUARANTEED benefit payouts for life. I know many of our agents stopped promoting income riders to their clients during the bull market times of the last ten years. Historical projections looked fantastic due to illustrations relying heavily on returns of the last decade. But times have changed. Consumer attitudes have changed. Many clients believe we will have a recession soon and a topsy turvy stock market will continue. So what’s the solution? We need to get back to income planning by asking our clients, “How much do you need and when do you need it?”When we know this, we can solve for how much premium we need to put into an index annuity with an income rider to pay out that needed benefit for life. Of course we’re still tied to an index, since these are index annuities, and we’ll be able to capture significant returns when the stock market does bounce back. But you’re protecting your clients from another downturn, should it happen. In conclusion, I think we need to look outside of the short-term MYGA market and look to solve your clients’ long-term income planning needs. Call the Ohlson Group so we can help design your client’s next Personal Pension Plan to solve their biggest problem – GUARANTEED lifetime income!

0 Comments

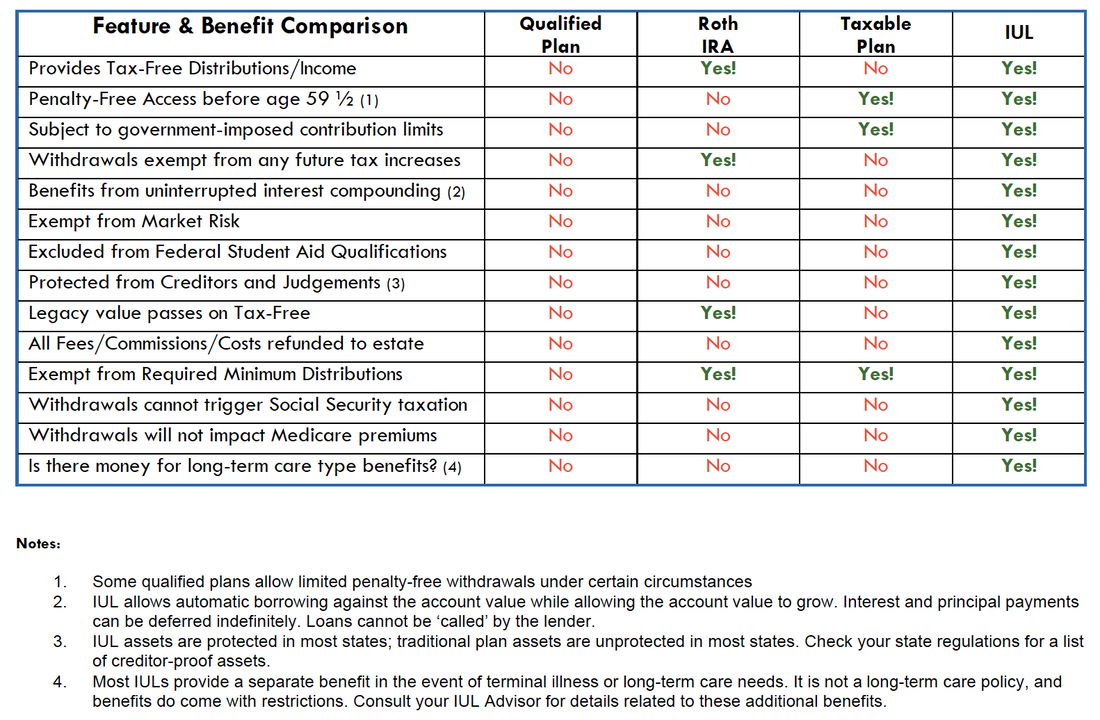

Distribution Matters! Retirement planning encompasses two crucial phases: the accumulation phase and the distribution phase. During the Accumulation Phase, which spans our working years, individuals set aside and invest income to prepare for retirement. This results in an account balance that accumulates until the day of retirement. The Distribution Phase commences on retirement day and continues throughout one's life. It involves converting accumulated accounts into income, ultimately determining the retiree's lifestyle in retirement. While much attention is often given to maximizing the account balance for retirement, it's essential to consider non-financial aspects and limitations when evaluating alternatives. The table below highlights some of these: Here Are Some Key Considerations:

1. Taxes Are Likely to Increase: Reviewing historical trends suggests an increased likelihood of future tax hikes, given the correlation between national debt and GDP. As the U.S. national debt has surged, reaching $33.17 trillion, a 312% increase in 15 years, many anticipate potential tax increases. 2. IUL as a Tax-Free Retirement Income Solution: Indexed Universal Life (IUL) presents a tax-efficient retirement solution. In addition to leveraging Roth IRAs, IUL can complement and address gaps left by other retirement accounts. IUL policies offer the potential for cash accumulation, tax-free income, accelerated living benefit riders, and an income tax-free death benefit. Under the current tax code (section 7702), permanent life insurance allows for retirement income not counted or taxed as income. The cash value serves as collateral for a tax-free loan against the death benefit, providing flexibility in withdrawals and loans during retirement. 3. Initiating the Tax-Free Retirement Income Conversation: To guide clients, educate them on tax risk using historical data and proposed legislation. Assess their current tax diversification and its implications for their financial situation. Utilize interactive client presentation tools to showcase the advantages of cash value life insurance compared to alternative financial tools. Making informed decisions involves comparing and analyzing results. By mastering this skill set, your confidence in navigating retirement planning options will grow. If you seek tools to enhance your sales experience, reach out to Levon Justice, our life insurance expert at the Ohlson Group, for assistance. We're here to help! 😊 Happy New Year! We at Ohlson Group cannot thank you enough for your support in 2023 and throughout the years. However, it is “primary season” and we are asking for your vote in 2024! No, we are not running for any political office – we are running (working hard!) to earn your vote (business) this year. Why link up with Ohlson Group? Here are some compelling reasons to make Ohlson Group your annuity and life IMO … Exclusive Annuity Leads We generate exclusive annuity leads for producers who are working with Ohlson Group. These are high-quality and exclusive annuity leads. The cost is much more palpable versus traditional lead vendors. Exclusive Branding Opportunity When you join Ohlson Group, you automatically become a member of The Safe Money Places Agent Network. Check out www.safemoneyplaces.com – we own this consumer site and use it to help enhance agents’ credibility. Additionally, we build Ohlson Group agents their own Safe Money Places themed website. You own the site – we maintain and update it for you and provide proprietary client-facing videos, consumer guides and storyboard scenarios. Savvy Marketing Team Ohlson Group also provides agents with case design and support. Our annuity and life marketers have been doing this for decades. We have subscriptions to all pertinent software and aggregator systems and work hand-in-hand with agents to ensure we find the best solution for your case. Back Office Support Our licensing, contracting and new business teams are second to none. We combine a personal touch (phone call and e-mail updates) as well as employing technology to help. We utilize a new technology to monitor your cases 24/7! Agent Commission Bonus: We realize nothing happens until one of you – our valued agents – sells something. We only feel it is right to reward quality producers with additional compensation. We pay hundreds of thousands of dollars in bonuses each year to agents. We make it easy to qualify as well. Have questions, just ask one of our marketers for details. In closing, we can all make 2024 a banner year. Annuity rates are still at or near all-time highs and we have an opportunity in front of us that only comes along every so often. Let’s take advantage of the opportunity, help our clients and make it a prosperous year. Give us a call and let us know how we can earn your Vote in 2024! |

Archives

July 2024

Categories |

Search Our Website to Find More Info, Tips, and Sales IdeasContact InformationOffice Address:

11611 N. Meridian Street | Ste 110 | Carmel, IN 46032 Phone: 1-877-844-0900 Fax: 317-844-4422 |

Quick Links |

THIS WEBSITE IS INTENDED FOR AGENT USE ONLY. NOT FOR USE BY CONSUMERS.

INFORMATION CONCERNING COPYRIGHT INFRINGEMENT CLAIMS

The Ohlson Group, Inc. provides links from its website to various third party sites which may enable you to obtain locations and information outside of The Ohlson Group's control. The Ohlson Group, Inc. neither controls nor endorses such other websites, nor have we reviewed or approved any content appearing on them. The Ohlson Group, Inc. does not assume any responsibility or liability for any materials available at these websites, or for the completeness, availability, accuracy, legality or decency of these sites.

CLAIMS OF COPYRIGHT INFRINGEMENT

The Digital Millennium Copyright Act of 1998, as amended, (the "DMCA") provides recourse for copyright owners who believe that material appearing on the Internet infringes their rights under U.S. copyright law. If you believe in good faith that materials we host infringe your copyright, you (or your agent) may send us a notice requesting that we remove the material or block access to it. If you believe in good faith that someone has wrongly filed a notice of copyright infringement against you, the DMCA permits you to send us a counter-notice. Notices and counter-notices must meet the then-current statutory requirements imposed by the DMCA; see http://www.loc.gov/copyright/ for details. Notices and counter-notices should be sent to [email protected]. The Ohlson Group, Inc., (877) 844-0900. We suggest that you consult your legal advisor before filing a notice or counter-notice. Also, please be aware that there are penalties for false claims under the DMCA.

The Ohlson Group Inc, and or Joseph R. Ohlson LUTCF is licensed to do business in all states except New York.

Privacy Policy

INFORMATION CONCERNING COPYRIGHT INFRINGEMENT CLAIMS

The Ohlson Group, Inc. provides links from its website to various third party sites which may enable you to obtain locations and information outside of The Ohlson Group's control. The Ohlson Group, Inc. neither controls nor endorses such other websites, nor have we reviewed or approved any content appearing on them. The Ohlson Group, Inc. does not assume any responsibility or liability for any materials available at these websites, or for the completeness, availability, accuracy, legality or decency of these sites.

CLAIMS OF COPYRIGHT INFRINGEMENT

The Digital Millennium Copyright Act of 1998, as amended, (the "DMCA") provides recourse for copyright owners who believe that material appearing on the Internet infringes their rights under U.S. copyright law. If you believe in good faith that materials we host infringe your copyright, you (or your agent) may send us a notice requesting that we remove the material or block access to it. If you believe in good faith that someone has wrongly filed a notice of copyright infringement against you, the DMCA permits you to send us a counter-notice. Notices and counter-notices must meet the then-current statutory requirements imposed by the DMCA; see http://www.loc.gov/copyright/ for details. Notices and counter-notices should be sent to [email protected]. The Ohlson Group, Inc., (877) 844-0900. We suggest that you consult your legal advisor before filing a notice or counter-notice. Also, please be aware that there are penalties for false claims under the DMCA.

The Ohlson Group Inc, and or Joseph R. Ohlson LUTCF is licensed to do business in all states except New York.

Privacy Policy

Copyright © 2024 The Ohlson Group, Inc. All Right Reserved.

RSS Feed

RSS Feed