|

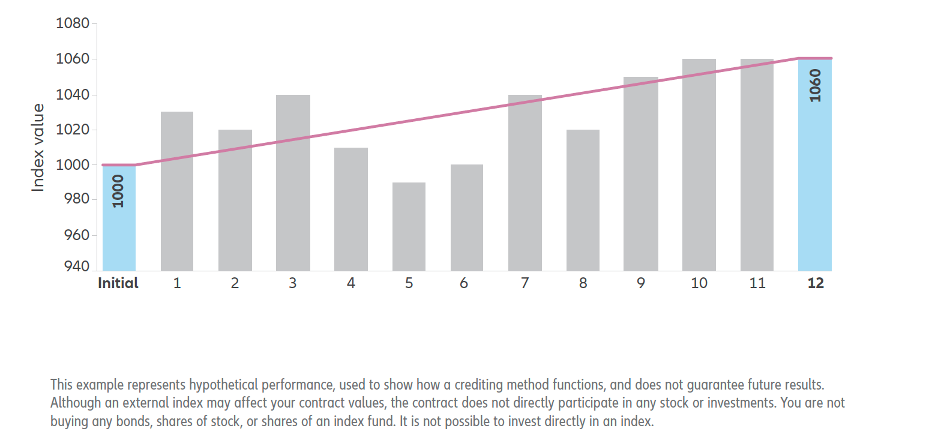

Fixed index annuities (FIAs) have many strong advantages to help protect your client’s savings and provide sustainable income over many years. Our goal is to help you gain a better understanding of the components that make up FIAs. This knowledge will enable you to make well informed decisions when it comes to product selection and design. FIAs accrue interest based on an external index, the index selected determines the amount of indexed interest received, which will fluctuate based on index change over the crediting period. The choice of the external index stands paramount. It is critical to explore the array of index options aligned with your FIA considerations. Equally crucial is the selection of the interest-crediting method for your FIA. The crediting method determines how fluctuations in the index will be calculated then credited to the annuity. The method chosen incorporates elements such as caps, spreads, and participation rates, which may greatly impact of indexed interest earned. In the subsequent sections, we delve into prevalent crediting methods, shedding light on how they work. Annual Point-to-PointA straightforward crediting methodology, annual point-to-point hinges on comparing the index value at two distinct points in time. This option could work well during periods of higher than usual mid-year volatility. Process Overview:

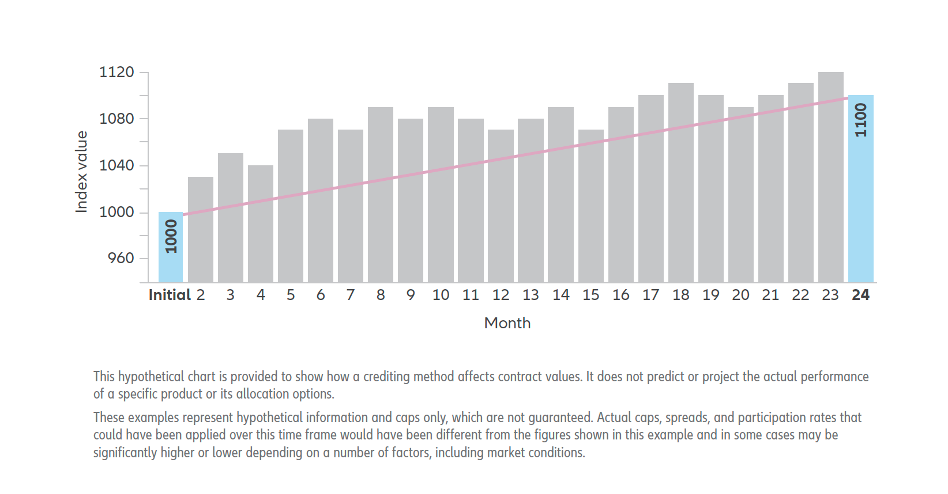

Illustrative Example: In a hypothetical scenario, if the ending index value surpasses the initial value by 6%, the indexed interest for the policy year could be contingent upon factors like a participation rate of 110%. Thus, the indexed interest would amount to 6.6%. However, if a cap is in place and is lower than the 6% increment, the indexed interest would be capped accordingly. Similarly, if a hypothetical scenario features a 3% spread, the indexed interest would be 3% (6% change in index value – 3% spread). Multi-Year Point-to-PointEchoing the principles of annual point-to-point, the multi-year point to point spans multiple years, thereby diminishing the influence of market volatility between the selected points. Process Overview:

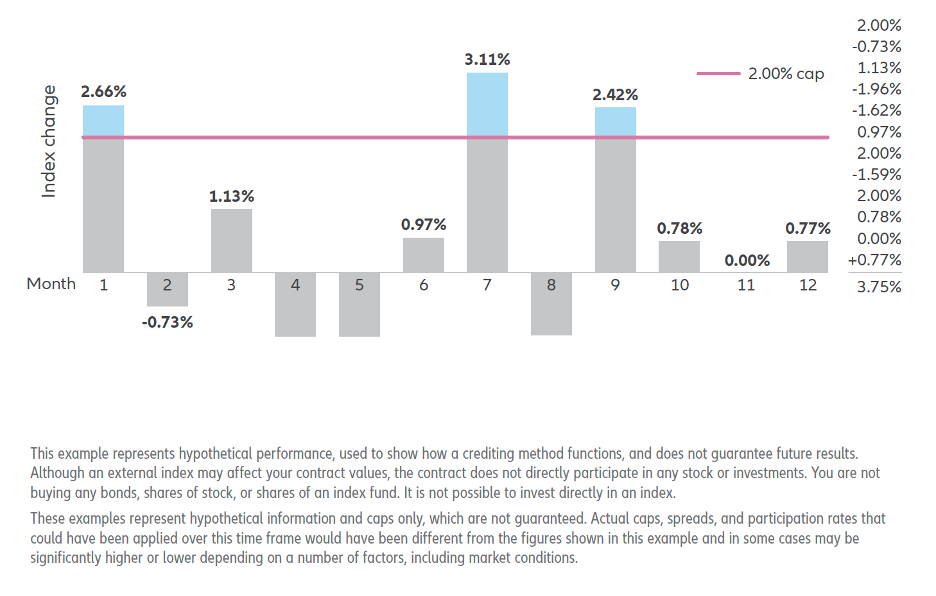

Illustrative Example: Consider a two-year point-to-point crediting scenario, where the ending index value outstrips the initial value by 10%. Assuming a participation rate of 150%, the indexed interest over the two contract years would amount to 15%. Monthly Sum This volatility-sensitive methodology tracks monthly index fluctuations, offering interest in buoyant markets while being susceptible to downturns. Process Overview:

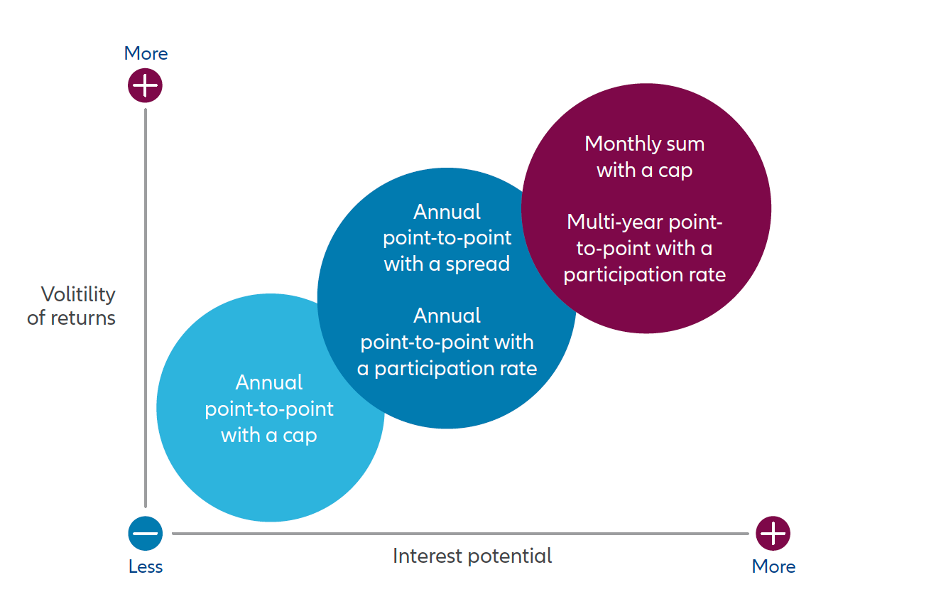

Illustrative Example: In a hypothetical monthly sum scenario with a 2.00% cap, monthly index fluctuations are evaluated. The cumulative sum determines the indexed interest, with any negative sum resulting in no interest accrual. FIA Crediting Methods: A Quick Overview Below is a chart outlining the relative sensitivity to performance volatility and interest potential of a few common Fixed Index Annuity (FIA) crediting methods.

Please note that this chart serves as a brief summary; it's essential to review the detailed descriptions of each crediting method before making a decision. Remember, no single method is universally superior. Depending on market conditions, one method may yield more interest than others—or no interest in a given year. Additionally, you have the option to combine crediting methods. Regardless of your choice, your accumulation value is safeguarded from negative performance.

0 Comments

When looking at net profits, money is the second of the assets that we must monitor and master. "Time" is the first asset, which you can read more on here.

I prefer to separate the money that I put into my business in two categories: Expenses and Investments. First, let’s look at and define our subset consisting of expenses and investments. Expenses are pretty easy to define. They are the basic items we need to run our practice. These are dollars spent to insure that we are able to adhere to the philosophy of Service, Credibility, Integrity and Profitability (SCIP®). Expenses are things like rent, telephone, salaries, supplies, fees paid to outside consultants, professional fees, website maintenance, business insurance, health insurance, office equipment and other things of this nature. This seems pretty straight forward but it always bares further investigation. It’s important to reevaluate your vendors at least once per year because the savings through this will increase your net profit. Expense is the biggest factor when you are trying to increase your net profit. Remember: Revenues - Expenses = Net Profit Let’s look at investments vs. expenses. Investments are costs associated with items that will either maintain or increase your net profit. Some investments must be made just to stay even and keep your flow of income. Others are dollars spent to get to the next level, such as increased advertising, website enhancement, increased direct mail, client appreciation events, new office furniture or a more prestigious location and continual education. What about a new hire dedicated to a new project? What about hiring an intern? How about hiring a public relations person to enhance your position in your community? These are investments. And there is no better place to invest in than your own business. You have the most control in this endeavor. When considering deficit spending and its possible values, just make sure you have a well thought out plan with the proper strategies and tactics to give you the best chance for success. People engage in “proper” deficit spending everyday. Kids and parents borrow money for college. Cities raise money through bonds to enhance and improve their communities. There are many more examples. Money is precious. Make sure you use it properly, for it is usually a finite asset and not never ending. You spend a lot of money to get in front of these prospects. So, doesn’t it just make good sense to give yourself the best opportunity of closing the sale? Time, money, and manpower are your assets. Don’t waste them! Set the stage for a successful conclusion to every sales meeting.

For many professionals, closing the sale always seems to be the toughest part of the sales cycle. If you have had this problem, don’t think you are all alone. It is the toughest part of any business. In fact, “closing the sale” applies to professions you may not have thought of. Consider these examples:

What all of these effective “sales persons” do that you may not be doing is “setting the stage” for the closing. They know, perhaps instinctively, how to prepare their “clients” for a definite conclusion. Setting the stage includes:

Here are four (4) general reasons that people don’t buy:

Understanding these “rejection factors” is why it’s important with every prospect to build trust, qualify them financially, and conduct a thorough needs analysis. A “fact finder” form allows you to find your prospect’s number one concern or need. Once you discover that need, you will be able to focus on it. As you present your story, you can make sure that you are addressing your prospect’s main concerns. Furthermore, during this fact finding process, you should never introduce new needs or concerns. The successful advisor always sticks to the big picture. If you do present new topics, you will sidetrack your discussion and move away from not toward closing the sale. Now, I know you’ve heard these tips hundreds of times. You know what to do ... but are you doing it? If not, you should review your branding and prospecting methods, examine your knowledge of your market, evaluate your time management procedures, and scrutinize your sales presentation. Again, at the heart of the process – the beginning of the sales call – is the use of fact finder interview. You would be amazed at the high percentage of advisors who don’t bother to use a fact finder. Most advisors simply walk in and try to dazzle their clients with their footwork and close a sale fast. Using a fact finder will separate you from the majority of financial sales people, because your clients and prospects will see you as the true, professional advisor. Do your homework – know your prospect, your products, and your market. Engage in some careful fact finding to identify the true needs of your client. Then, begin your “pitch” while staying on track throughout the conversation until you reach the conclusion. You will find that if you accomplish these steps, closing the sale will be the obvious and normal conclusion you and your client reach. I can't remember who first said the title above, but I know that it has been repeated for years. For many, it falls on deaf ears. Many think that they can just "wing it.” Well, the very greatest can sometimes wing it for a while. But, as things get more complex, one starts running out of hours in the day, or the rules change, then we find that we needed a plan to be able to address any of the aforementioned challenges. The following is from the book "The Best of Success," compiled by Wynn Davis. "Planning is like a road map. It can show us the way, head us in the right direction, and keep us on course. Planning means mapping out how to get from where we are now to where we want to be. Planning is the power tool for achievement - the magic bridge to our goal."

I think this sums things up pretty well. We are entering the planning season for next year, and it is time to start thinking about the plan. Income goals, market goals, digital marketing, branding, sales numbers and more. In my opinion, you need a template. You should make this as easy as possible. Therefore, I suggest that the best plan is the one year plan. You can start looking out further once you are implementing the plan. You want to keep the plan flexible and have exit strategies and plans 2 and 3. Because, as you have seen, the world changes faster now than ever before. So, that challenge also presents a tremendous opportunity. You can get there faster than your competition if the plan is ready to kick off on January 1st. So, the time to start is now. As I conclude this short commentary, I would like to offer up The Ohlson Groups business plan and marketing plan templates. I like to use the "KISS” method... Keep It Simple Stupid. And, I am addressing this to me and The entire Ohlson Group. We have the tools to assist you in reaching your goals. But, we have to have a plan. So, schedule a planning session with one of our marketing consultants. I close with the following, "Reduce your plan to writing... the moment you complete this, you will have definitely given concrete form to the intangible desire." Thanks for your attention and until next time... good selling! |

Archives

July 2024

Categories |

Search Our Website to Find More Info, Tips, and Sales IdeasContact InformationOffice Address:

11611 N. Meridian Street | Ste 110 | Carmel, IN 46032 Phone: 1-877-844-0900 Fax: 317-844-4422 |

Quick Links |

THIS WEBSITE IS INTENDED FOR AGENT USE ONLY. NOT FOR USE BY CONSUMERS.

INFORMATION CONCERNING COPYRIGHT INFRINGEMENT CLAIMS

The Ohlson Group, Inc. provides links from its website to various third party sites which may enable you to obtain locations and information outside of The Ohlson Group's control. The Ohlson Group, Inc. neither controls nor endorses such other websites, nor have we reviewed or approved any content appearing on them. The Ohlson Group, Inc. does not assume any responsibility or liability for any materials available at these websites, or for the completeness, availability, accuracy, legality or decency of these sites.

CLAIMS OF COPYRIGHT INFRINGEMENT

The Digital Millennium Copyright Act of 1998, as amended, (the "DMCA") provides recourse for copyright owners who believe that material appearing on the Internet infringes their rights under U.S. copyright law. If you believe in good faith that materials we host infringe your copyright, you (or your agent) may send us a notice requesting that we remove the material or block access to it. If you believe in good faith that someone has wrongly filed a notice of copyright infringement against you, the DMCA permits you to send us a counter-notice. Notices and counter-notices must meet the then-current statutory requirements imposed by the DMCA; see http://www.loc.gov/copyright/ for details. Notices and counter-notices should be sent to [email protected]. The Ohlson Group, Inc., (877) 844-0900. We suggest that you consult your legal advisor before filing a notice or counter-notice. Also, please be aware that there are penalties for false claims under the DMCA.

The Ohlson Group Inc, and or Joseph R. Ohlson LUTCF is licensed to do business in all states except New York.

Privacy Policy

INFORMATION CONCERNING COPYRIGHT INFRINGEMENT CLAIMS

The Ohlson Group, Inc. provides links from its website to various third party sites which may enable you to obtain locations and information outside of The Ohlson Group's control. The Ohlson Group, Inc. neither controls nor endorses such other websites, nor have we reviewed or approved any content appearing on them. The Ohlson Group, Inc. does not assume any responsibility or liability for any materials available at these websites, or for the completeness, availability, accuracy, legality or decency of these sites.

CLAIMS OF COPYRIGHT INFRINGEMENT

The Digital Millennium Copyright Act of 1998, as amended, (the "DMCA") provides recourse for copyright owners who believe that material appearing on the Internet infringes their rights under U.S. copyright law. If you believe in good faith that materials we host infringe your copyright, you (or your agent) may send us a notice requesting that we remove the material or block access to it. If you believe in good faith that someone has wrongly filed a notice of copyright infringement against you, the DMCA permits you to send us a counter-notice. Notices and counter-notices must meet the then-current statutory requirements imposed by the DMCA; see http://www.loc.gov/copyright/ for details. Notices and counter-notices should be sent to [email protected]. The Ohlson Group, Inc., (877) 844-0900. We suggest that you consult your legal advisor before filing a notice or counter-notice. Also, please be aware that there are penalties for false claims under the DMCA.

The Ohlson Group Inc, and or Joseph R. Ohlson LUTCF is licensed to do business in all states except New York.

Privacy Policy

Copyright © 2024 The Ohlson Group, Inc. All Right Reserved.

RSS Feed

RSS Feed