|

The conventional approach to designing accumulation-focused Indexed UL strategies involves minimizing the death benefit. Often, this is combined with using the maximum AG49 compliant illustrated rate to squeeze every dollar of projected income out of the product. While that can produce a compelling illustration, it may not be the most effective approach in the real world. That thought process is often the reason for things like stress testing or reducing the illustrative rate, even if it results in a reduced illustrative income. The truth is there is another, perhaps more meaningful alternative design that can deliver more consumer value from virtually any Indexed UL product. This more balanced approach to case design can deliver:

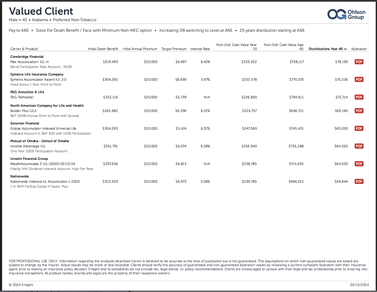

What's the Bottom Line?An additional $248,387 in coverage, an increase of over 61% versus a traditional design. The product includes a Chronic Illness ABR that is now based on a 61% larger face amount, putting more cash at the client’s fingertips when they need it most:

Over $14,000 in additional funding capacity per year. Remember, all the testing that limits how much premium you can contribute “rolls” forward. By the 10th policy year there is a whopping $140,000 of additional funding capacity. What's in it for the Advisor?As the face amount increases, so does the Target Premium. Using this consumer value packed approach increases Target Premium by 61%. What Products Work with this Approach?This strategy likely works with the majority of accumulation focused IUL products. Case design will be a manual process. Increasing the face amount from a maximum accumulation solve by 50% might be a good starting point. Need a hand creating illustration examples for your prospects? Contact the Life Department at Ohlson Group. We will help put your case together and provide supporting marketing material and case submission / and underwriting assistance. Download a Male 45, Preferred Non-Tobacco PDF Flyer

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

Search Our Website to Find More Info, Tips, and Sales IdeasContact InformationOffice Address:

11611 N. Meridian Street | Ste 110 | Carmel, IN 46032 Phone: 1-877-844-0900 Fax: 317-844-4422 |

Quick Links |

THIS WEBSITE IS INTENDED FOR AGENT USE ONLY. NOT FOR USE BY CONSUMERS.

INFORMATION CONCERNING COPYRIGHT INFRINGEMENT CLAIMS

The Ohlson Group, Inc. provides links from its website to various third party sites which may enable you to obtain locations and information outside of The Ohlson Group's control. The Ohlson Group, Inc. neither controls nor endorses such other websites, nor have we reviewed or approved any content appearing on them. The Ohlson Group, Inc. does not assume any responsibility or liability for any materials available at these websites, or for the completeness, availability, accuracy, legality or decency of these sites.

CLAIMS OF COPYRIGHT INFRINGEMENT

The Digital Millennium Copyright Act of 1998, as amended, (the "DMCA") provides recourse for copyright owners who believe that material appearing on the Internet infringes their rights under U.S. copyright law. If you believe in good faith that materials we host infringe your copyright, you (or your agent) may send us a notice requesting that we remove the material or block access to it. If you believe in good faith that someone has wrongly filed a notice of copyright infringement against you, the DMCA permits you to send us a counter-notice. Notices and counter-notices must meet the then-current statutory requirements imposed by the DMCA; see http://www.loc.gov/copyright/ for details. Notices and counter-notices should be sent to [email protected]. The Ohlson Group, Inc., (877) 844-0900. We suggest that you consult your legal advisor before filing a notice or counter-notice. Also, please be aware that there are penalties for false claims under the DMCA.

The Ohlson Group Inc, and or Joseph R. Ohlson LUTCF is licensed to do business in all states except New York.

Privacy Policy

INFORMATION CONCERNING COPYRIGHT INFRINGEMENT CLAIMS

The Ohlson Group, Inc. provides links from its website to various third party sites which may enable you to obtain locations and information outside of The Ohlson Group's control. The Ohlson Group, Inc. neither controls nor endorses such other websites, nor have we reviewed or approved any content appearing on them. The Ohlson Group, Inc. does not assume any responsibility or liability for any materials available at these websites, or for the completeness, availability, accuracy, legality or decency of these sites.

CLAIMS OF COPYRIGHT INFRINGEMENT

The Digital Millennium Copyright Act of 1998, as amended, (the "DMCA") provides recourse for copyright owners who believe that material appearing on the Internet infringes their rights under U.S. copyright law. If you believe in good faith that materials we host infringe your copyright, you (or your agent) may send us a notice requesting that we remove the material or block access to it. If you believe in good faith that someone has wrongly filed a notice of copyright infringement against you, the DMCA permits you to send us a counter-notice. Notices and counter-notices must meet the then-current statutory requirements imposed by the DMCA; see http://www.loc.gov/copyright/ for details. Notices and counter-notices should be sent to [email protected]. The Ohlson Group, Inc., (877) 844-0900. We suggest that you consult your legal advisor before filing a notice or counter-notice. Also, please be aware that there are penalties for false claims under the DMCA.

The Ohlson Group Inc, and or Joseph R. Ohlson LUTCF is licensed to do business in all states except New York.

Privacy Policy

Copyright © 2024 The Ohlson Group, Inc. All Right Reserved.

RSS Feed

RSS Feed