|

Most of us came in this business hearing the famous selling tip- KISS….keep it simple stupid. This acronym has never been as important as it is in today’s fixed annuity arena. Remember, when we speak of fixed annuities, we are addressing the traditional fixed and the “fixed” index annuities.

Let’s focus for a minute on the index annuity market. This is a “goofy” market. Have you even seen anything like this in your insurance career? We have products that take most agents 30 minutes to understand. How are we supposed to explain them to a prospect or client in three (3) minutes? Please allow me to quote Jack Marrion, President of the Advantage Compendium, “Fixed index annuities can best be described as savings instruments offered by insurance companies that provide a minimum guaranteed return. Insurance companies’ earnings, above and beyond what is needed for this minimum guarantee, are used to purchase an index-link providing the potential for the crediting of excess interest above the minimum guarantee.” Sounds pretty simple, doesn’t it? This is even better when you explain to the prospect that their principal and past interest gains are never subject to investment risk. They are backed by the faith and credit of the insurance company. This is safe and this is simple. Some might want a simple explanation of the difference between a “fixed rate” annuity and a “fixed index” annuity. Marrion says, “The difference between the two is that with a fixed index annuity, most of the interest paid is used to buy an index-link on an equity index. This gives your client the potential for more interest if the index cooperates.” This sounds pretty simple to me. You do, of course, have the benefit of many fine point of sales pieces along with historical performances of each crediting methodology. So what’s happened? Why all the confusion? Okay, many companies have made these products difficult to understand ... too many index choices and too many games. Some products have stretched the surrender periods without giving anything back to the client. Don’t get me wrong, long surrender periods are okay if the client gets something in exchange and fully understands what he/she is buying. Some products will never, in my opinion, perform well. Why? They are building in unmanageable commission structures. I like high commissions as well as anyone, but not at the expense of our clients.

Before we analyze potential changes, let’s look at the traditional “fixed annuity.” The traditional, non-index annuity, has been around for quite some time. It has really served a great purpose. People have been able to save money through this vehicle on a tax deferred basis. The last ten (10) years provided our industry with an excellent opportunity for explosive growth. Boy did it ever happen! Bank annuity sales took off; agents were experiencing tremendous increase in incomes and companies’ assets exploded. The annuity design was simple. They mimicked CDs. That’s the greatest benchmark for today’s consumer – “is this annuity paying more than my CD?” This is very important because that is the most important factor in your client’s decision to purchase. Tax deferred growth, freedom from probate and an income they can’t outlive is a distant second to “beating” the CD. But things started to get a little cloudy. Let’s take a look. Companies wanted an increase in market share. They wanted more assets under management. Remember, that’s one of the two (2) biggest factors in which an insurance company makes money. It’s called the spread. It’s the difference between what the company earns in investment income and what they pay your client. The bigger the spread…..the bigger the profit. The other main factor is expense (home office costs and of course, your commissions). So, enter the day of the first year bonus. This “sizzling” first year rate brought in a lot of money. These bonuses have brought about some critics from the press, as well as, disgruntled clients. Why? Renewal rates, in many cases, tanked. These were declared rate annuities that allow the company to “declare” where they set the renewal rates. Many companies in search of income reduced your client’s rate to increase the spread. Wall Street liked it….but not the policyholder. I believe that it’s in your best interest, as well as your clients, to purchase a multi-year rate guaranteed annuity if you are not proposing an index annuity. Otherwise, your client is saving in a vehicle with no guarantee of future results. They surely wouldn’t do this with a bank CD. Don’t get me wrong, there are plenty of honorable companies that will treat your client fairly. Also, we do want the company to be profitable. They are our partners. There are many ways to analyze a company to determine how they will renew your client’s rates:

I have been fortunate to be on both sides of the fence. I’ve been an insurance company president as well as having twenty (20) plus years in the field as an agent, general agent and owner of an insurance marketing organization. So, please excuse me if I tend to over-analyze. But, I am happy to say that the next couple of years will get our annuity industry back on track. Companies are now designing new products, pulling old products and adhering to new regulatory guidelines. The business is going to be better than ever! The policyholder, the insurance company and the agent will all do well! We are getting back to a level playing field. I, for one, am extremely happy with the direction our industry MUST take if we are going to be able to operate profitably without government intervention. So, what do we do next? Here we go: Sell only what you believe in. Don’t rationalize away parts of the contract you don’t like. Only sell “GOOD STUFF”. Have a concise presentation that provides your prospect or client with all the information they need to make a decision. They buy easier when they understand what you are selling. Don’t over promise. Don’t sell the stock market. This isn’t an investment. The fixed index annuity is the most important annuity in the industry. Seniors and Boomers will continue to buy. Our future is bright for multiple sales of annuities and ancillary products - but, only if they are happy with previous purchases. This product is simple and beautiful. Sell it properly and you will profit immensely. The answer is simple. Sell it right and sell what’s good. Good for everyone. We can’t lose. Until Next Time ... Good Selling!

0 Comments

While obtaining leads is most advisor’s number one priority, the 2nd most important step is closing the sale. In order to do this, you must put yourself in your client’s shoes and ask the appropriate questions. Along with that, you should provide them with professional services to build relationships, trust, and position yourself as their trusted financial consultant. Let's discuss 5 sales tips for annuity selling insurance agents to help you boost sales and continue achieving your goals: 1. Understand Your Target Market: The first step in selling annuities is to have a deep understanding of your target market. Who are your ideal clients and what are their needs and concerns? What are their financial goals? Understanding your target market will enable you to tailor your sales approach and messaging to resonate with them. This will help you identify the right prospects and focus your efforts on those who are most likely to be interested in purchasing annuities. 2. Build Trust and Establish Relationships: Selling annuities is not just about making a one-time sale, but also about building long-term relationships with your clients. Trust is crucial in the insurance industry, and it takes time to establish. Be honest, transparent, and professional in your interactions with clients. Take the time to understand their financial situation, goals, and concerns. Educate them about annuities and how they can benefit from them. Listen attentively to their needs and provide personalized solutions. Building trust and establishing relationships will help you earn repeat business and referrals, which are essential for long-term success in annuity sales. 3. Be a Trusted Advisor: As an insurance agent, it's important to position yourself as a trusted advisor rather than just a salesperson. Your clients are looking for someone who can provide expert advice and guidance on their financial matters. Educate yourself about annuities, including the different types, features, benefits, and risks. Stay updated with the latest industry trends and regulations. Be prepared to answer questions, address concerns, and provide accurate information to help your clients make informed decisions. By positioning yourself as a trusted advisor, you will build credibility and confidence with your clients, leading to increased sales. 4. Customize Your Sales Approach: Not all annuity prospects are the same, and a one-size-fits-all sales approach may not be effective. Customize your sales approach based on each client's unique needs, goals, and preferences. Tailor your messaging to resonate with their specific situation. Use language that they can understand, avoiding technical jargon. Use visual aids, such as charts or illustrations, to simplify complex concepts. Be flexible and adaptive in your sales approach, and be prepared to adjust your strategy based on the feedback and responses from your clients. A customized approach will show your clients that you genuinely care about their individual needs, which can significantly impact your sales success. 5. Provide Excellent Customer Service: Excellent customer service is essential in any sales role, and annuity sales are no exception. Be responsive to your clients' inquiries, whether it's through phone calls, emails, or in-person meetings. Be prompt and reliable in providing information or assistance. Be patient and empathetic, especially when dealing with clients who may have concerns or questions about annuities. Demonstrate professionalism and integrity in all your interactions with clients, even after the sale is made. By providing excellent customer service, you will not only retain your existing clients but also receive positive reviews and referrals, which can contribute to your sales growth. Now that these tips are fresh in your head, it's time to reach out to your leads. Dig into your CRM or prospect pool and see how you can help them. Perhaps it's through providing some quotes or wealth transfer strategies, sending educational consumer materials, or maybe re-introducing yourself and remind them you're here for them. Just because a lead hasn't converted yet, doesn't mean they won't. Is Your Annuity Supply Low?We can help with that! Let us give you contact information for leads who are actively searching for annuity information. And the best part? Our in-house generated annuity leads cost around 1/3 of the price of other annuity lead vendors! Implement your sales knowledge today!

This was the first lesson drilled into me during the initial week of sales training at one of the most established and entrusted insurers in our industry. I’ve learned it’s much better to ask open ended questions, listen, ask permission to take notes, then repeat what you heard back to the client. This demonstrates that beyond listening, you seek to understand where they are coming from. This is step one in establishing yourself as someone worthy of trust. If you are smooth enough, use their name while doing so, and you’ll earn a few extra brownie points. After all, everyone’s favorite subject is themselves, their family, or their business.

Some advisors “wing it” or meet with a client with sales illustration in hand ready to go. However, I propose a different approach. By asking your prospects these 5 key questions during your initial meeting, you’ll find prospects reveal more about themselves when asked a thought-provoking question. This strategy change can move you from being perceived as “selling a product” towards being viewed as a problem solver, and who wouldn’t want that? Prospects often say things like, “Those are good questions, you’ve really got me thinking...” or “Wow, no one’s asked me this before!” Ask these questions, schedule your next appointment while you’re there, send a follow up letter, then share what you’ve learned with us. We can help you put together the product solutions and illustrations that work best. Create a great referral plan and your business will sustain itself for years to come. Yes, I know that the MYGA (Multi Year Guarantee Annuity) market is hot. With the Fed steadily raising rates over the last year, the marketplace has seen an explosion in fixed annuity business. And with the inverted yield curve, the short term rates are even better than long term rates! Lastly, with the stock market being rocky, clients are flocking to guarantees. While all of this equals great returns for short-term planning for your clients, we shouldn’t lose focus on long-term goals. I’d like to re-introduce you to the “other" MYGAs. I’m talking about guaranteed lifetime withdrawal benefits, or income riders. In my opinion, right now is the perfect time to sell these GLWBs. The products give your clients GUARANTEED growth to the income account value and GUARANTEED benefit payouts for life. I know many of our agents stopped promoting income riders to their clients during the bull market times of the last ten years. Historical projections looked fantastic due to illustrations relying heavily on returns of the last decade. But times have changed. Consumer attitudes have changed. Many clients believe we will have a recession soon and a topsy turvy stock market will continue. So what’s the solution? We need to get back to income planning by asking our clients, “How much do you need and when do you need it?”When we know this, we can solve for how much premium we need to put into an index annuity with an income rider to pay out that needed benefit for life. Of course we’re still tied to an index, since these are index annuities, and we’ll be able to capture significant returns when the stock market does bounce back. But you’re protecting your clients from another downturn, should it happen. In conclusion, I think we need to look outside of the short-term MYGA market and look to solve your clients’ long-term income planning needs. Call the Ohlson Group so we can help design your client’s next Personal Pension Plan to solve their biggest problem – GUARANTEED lifetime income!

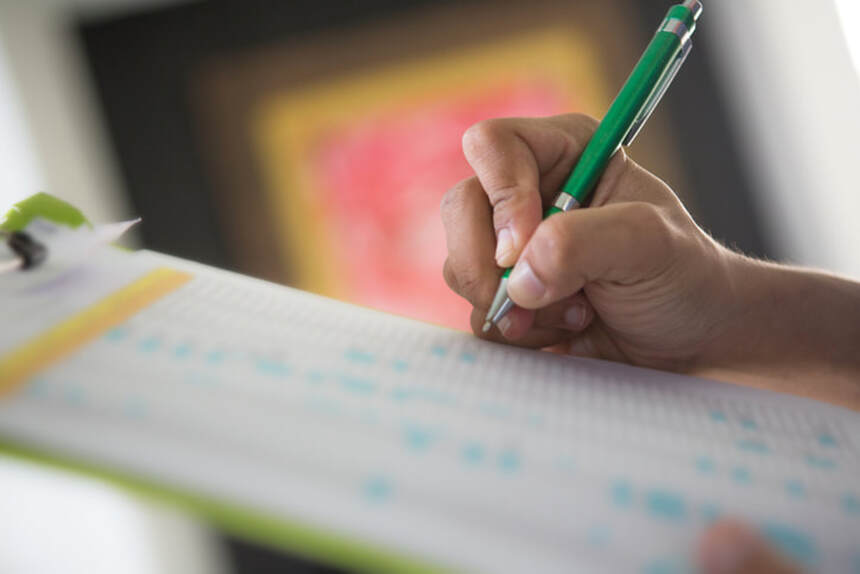

Distribution Matters! Retirement planning encompasses two crucial phases: the accumulation phase and the distribution phase. During the Accumulation Phase, which spans our working years, individuals set aside and invest income to prepare for retirement. This results in an account balance that accumulates until the day of retirement. The Distribution Phase commences on retirement day and continues throughout one's life. It involves converting accumulated accounts into income, ultimately determining the retiree's lifestyle in retirement. While much attention is often given to maximizing the account balance for retirement, it's essential to consider non-financial aspects and limitations when evaluating alternatives. The table below highlights some of these: Here Are Some Key Considerations:

1. Taxes Are Likely to Increase: Reviewing historical trends suggests an increased likelihood of future tax hikes, given the correlation between national debt and GDP. As the U.S. national debt has surged, reaching $33.17 trillion, a 312% increase in 15 years, many anticipate potential tax increases. 2. IUL as a Tax-Free Retirement Income Solution: Indexed Universal Life (IUL) presents a tax-efficient retirement solution. In addition to leveraging Roth IRAs, IUL can complement and address gaps left by other retirement accounts. IUL policies offer the potential for cash accumulation, tax-free income, accelerated living benefit riders, and an income tax-free death benefit. Under the current tax code (section 7702), permanent life insurance allows for retirement income not counted or taxed as income. The cash value serves as collateral for a tax-free loan against the death benefit, providing flexibility in withdrawals and loans during retirement. 3. Initiating the Tax-Free Retirement Income Conversation: To guide clients, educate them on tax risk using historical data and proposed legislation. Assess their current tax diversification and its implications for their financial situation. Utilize interactive client presentation tools to showcase the advantages of cash value life insurance compared to alternative financial tools. Making informed decisions involves comparing and analyzing results. By mastering this skill set, your confidence in navigating retirement planning options will grow. If you seek tools to enhance your sales experience, reach out to Levon Justice, our life insurance expert at the Ohlson Group, for assistance. We're here to help! 😊 Happy New Year! We at Ohlson Group cannot thank you enough for your support in 2023 and throughout the years. However, it is “primary season” and we are asking for your vote in 2024! No, we are not running for any political office – we are running (working hard!) to earn your vote (business) this year. Why link up with Ohlson Group? Here are some compelling reasons to make Ohlson Group your annuity and life IMO … Exclusive Annuity Leads We generate exclusive annuity leads for producers who are working with Ohlson Group. These are high-quality and exclusive annuity leads. The cost is much more palpable versus traditional lead vendors. Exclusive Branding Opportunity When you join Ohlson Group, you automatically become a member of The Safe Money Places Agent Network. Check out www.safemoneyplaces.com – we own this consumer site and use it to help enhance agents’ credibility. Additionally, we build Ohlson Group agents their own Safe Money Places themed website. You own the site – we maintain and update it for you and provide proprietary client-facing videos, consumer guides and storyboard scenarios. Savvy Marketing Team Ohlson Group also provides agents with case design and support. Our annuity and life marketers have been doing this for decades. We have subscriptions to all pertinent software and aggregator systems and work hand-in-hand with agents to ensure we find the best solution for your case. Back Office Support Our licensing, contracting and new business teams are second to none. We combine a personal touch (phone call and e-mail updates) as well as employing technology to help. We utilize a new technology to monitor your cases 24/7! Agent Commission Bonus: We realize nothing happens until one of you – our valued agents – sells something. We only feel it is right to reward quality producers with additional compensation. We pay hundreds of thousands of dollars in bonuses each year to agents. We make it easy to qualify as well. Have questions, just ask one of our marketers for details. In closing, we can all make 2024 a banner year. Annuity rates are still at or near all-time highs and we have an opportunity in front of us that only comes along every so often. Let’s take advantage of the opportunity, help our clients and make it a prosperous year. Give us a call and let us know how we can earn your Vote in 2024! Most agents have heard and live by the Standard 10-3-1 Rule (10 leads, 3 appointments, 1 sale). As long as you can achieve that level of performance and closing ratios, you will earn a decent living. Of course, the main goal of each lead campaign is to set appointments and make a sale. However, one of the most important aspects of lead campaigns is often overlooked… leads are fundamental towards building a database of prospects with on-going sales opportunities.

It’s easy for all of us to forget that purchasing an annuity is a HUGE financial decision that takes a lot of time and care to consider. People have worked their entire lives to build up their retirement savings so they can enjoy their golden years. Therefore, they are (and should be) ultra protective of those assets. This leads me to my next point, that most leads will not become sales and clients within 30 days. Simply put, that’s really not enough time for most people to make a larger financial decision, especially for many, the last major one that affects their entire retirement moving forward. Most advisors in the field tend to operate on a “hunting prospecting sales strategy” versus a “farming prospecting sales strategy”. Hunting type of sales approach means one only tries reaching the leads for a short time, such as 2 weeks. If the agent doesn’t connect with that person after XX of attempts within 14 days, they simply stop contacting them and move on. These agents assume if they can’t connect to the lead within that time frame, that a sale is unlikely. However, some of the most successful advisors beg to differ. One of our most successful producers increased his annual production tremendously (30% or more in the first year) after he went from a “hunting” prospecting sales method to a “farming” strategy. His system helped him go from a $8-$10M Producer to a $20+M producer. What he found was there were a lot of “low hanging fruit” in his database of his older leads. So, by creating a long-term drip system, he was able to stay in contact and top of mind with those leads as they become closer to the buying stage of the sales cycle. And the best thing, his ROI improved because he was no longer just throwing away money by tossing away the lead after 30 days… he now had a lead until the person says “stop calling”. This is one example of why building a database of prospects is just as important as the immediate sale. It creates scalable growth by having a pool of future sales opportunities. Since we run a successful lead program, we’ve seen it ourselves first-hand. We’ve had leads reconvert through our system 6 months later, even 12 months later, and at that point, will become a sale. With our lead program, we have the ability to notify the agent who is tied to that lead exclusively, and they have made sales from those leads in the past. For us, this ongoing lead system is a long-term marketing strategy that resembles a farming sales and marketing strategy. So… what is a “farming prospecting sales strategy” and how do you create one? This strategy means the agent has created a long-term drip marketing process built around a database of prospects of potential sales. Basically, agents have some sort of system in place to keep the sale alive for longer. Some agents simply have a CRM where they automate follow-up reminder tasks. For example, they set the CRM to remind them to manually send emails and call people periodically… like 2X per month. Other advisors have a full-on automated drip marketing system that sends out emails frequently, text messages periodically, and reminder tasks to regularly make phone calls. Regardless if you’re a tech guru or not… the main thing to develop a “farming prospecting sales method” is to create a long-term drip process. This could literally be something as simple as having email templates written up in Microsoft Word and a spreadsheet in Excel that helps you stay organized on your follow-ups. Next time you run a lead campaign, please try to keep in mind, you may have a lot more sales opportunities than what presents itself within 30 days. It’s important to put yourself in your client’s shoes. I would encourage you to ask yourself, “How much time would you need to research the product solution, the advisor, and reflect on whether purchasing a $250k annuity is a good decision?” Would you need more than 2 weeks to make that decision? I don’t know about you, but I’d spend more than 30 days researching a car purchase, much less an annuity! Many people simply need more time to make that decision. They may be nearing retirement but are still working and are preparing to retire 90 days or even 6 months to a year later. So, it’s important to stay in consistent communication with one another. Want to learn more on our specific annuity lead program, or would like some general tips? Give us a call today or schedule an appointment with one of our senior marketers. September is just around the corner and that means back to school, back from summer vacations and hopefully a break from the summer heat!

As you prepare to settle in for the 3rd quarter of business this year, I’d like you to take a moment to focus on your client’s life insurance needs. After all... September is Life Insurance Awareness Month. Click Here For Marketing Guide Remember, talk about what these products can do for your clients. Help them understand why choosing to commit their hard-earned money to a life insurance program has a lifetime of benefits for them and their survivors. To quote the inspirational writer Paul Speicher: “A life insurance policy is just a time yellowed piece of paper with columns, figures and legal phrases, until it is baptized with a widow’s tears. Then it becomes a modern miracle, an Aladdin’s lamp. It is FOOD, CLOTHING, SHELTER, EDUCATION, PEACE OF MIND, COMFORT, UNDYING LOVE AND AFFECTION. It is the sincerest love letter ever written.” Take Advantage of our Life Insurance Case Design and Illustration Services Whether you have a case with underwriting challenges or a simple one that should fly right through, we have the tools necessary to go from quote to application all on our website. Need to Quote a Term Life Case? Simply click our Life Insurance tool and you’ll find the products and carriers best suited to meet your clients needs or wants. Is Final Expense Your Product of Choice? We also have an easy way to sort out the field of options and provide you with quotes, product information and applications. Want Help Finding the Perfect a Permanent Life Insurance Product? Lastly, when permanent insurance is called for, whether it’s participating whole life, indexed universal life or no lapse guarantee universal life, just book an appointment. We’ll work with you to provide a detailed case review including underwriting, sales concept presentations, comparisons and analysis. Love and legacy is everything, so help them continue to pass it on! If you’re looking for a hand with your next life case schedule a call with one of our team members, call us at (877) 844 0900, or email us at info@ohlsongroup.com. After the recent choppiness in the market, annual meetings with your clients for re-allocation can be difficult. Especially if there is a rider attached to their indexed annuity.

That annuity that we said would not lose money, may have decreased in value on the statement. We all know the income is safe and not affected by this. However, what the client sees on their statement is the starting balance and the ending balance less any rider fees. Explaining this can be difficult, because the client sees it in black and white. When we set up the allocation, it is tempting to diversify in the markets with strong caps or par rates. They give your client the best upside potential long-term, and we all want what is best for our client. But, don’t forget an allocation to the fixed rate. Right now, fixed rates are at historical highs. Even if it’s enough to cover the rider expense, at least you will have a positive (on paper) return to show your client. For more tips like this, please reach out by booking an appointment below. These are very interesting times in the financial services industry. We’ve had many unusual challenges in the past, but today, the threats affect every part of our business. Today, I am focusing on the insurance based industry and all that participate in this arena. All parties are making plans. The big question is... Will you/we be part of the plan? Let's look at a few of the challenges:

The first is the declining ranks in our business. Agents/advisors are getting older and there aren't enough "new babies" coming into the business. So, the insurance companies are wondering where they will get the production. Will the independent/IMO channel give them the desired premium or do they focus on alternative distribution through banks, broker-dealers and direct response? I think you will see a little of each. I don't think, at this time, that they will forsake the independent channels. What about IMOs like The Ohlson Group? We are in the same boat. We have to always have a plan to garner the appropriate amount of premium to have enough profit to fulfil the promises made to our advisors. Fortunately for us, we have a strong life insurance background and have been increasing life sales to complement our annuity sales. What about the most important asset… the advisor in the field? How will they continue to get in front of good qualified prospects, keep their expenses reasonable, and grow as planned? Will the DOL/Fiduciary rule get in the way? Will commissions be reduced or spread out? Who knows… but we must keep moving forward. So, what are some of the answers being produced? Collaboration: Loosely defined, cooperative arrangement in which two or more parties (which may or may not have any previous relationship) work jointly towards a common goal. This is what we’re doing at The Ohlson Group. We have many mid-sized IMOs and agencies that are now working with The Ohlson Group to take advantage of our digital marketing prowess and are in the Safe Money Places Agent Network. This is where we feel the greatest growth and prosperity will occur. We also do the reverse and collaborate with other IMOs that have resources that we can access as well. A very real time example is the fact that over 50 IMOs are using AssessBEST as the vehicle to protect and enhance the careers of our advisors. Consolidate: “To bring together into a single or united whole to become, or cause something to become, stronger and more certain.” I have witnessed several IMOs that are doing this. Many are being purchased. I also think you will see the same happening with the insurance companies that don't feel as though they have enough muscle or capital to stay in the game. Consternation: “A sudden, alarming amazement or dread that results in utter confusion and dismay.” I believe that the DOL/Fiduciary rule has taken consternation to a level not seen in recent years. So, regarding this regulation, the advisor needs to make sure that the IMO is providing everything needed in the areas of marketing, research and education. Plus, the tools to make sure everyone is compliant in this brave new world. In closing, the opportunities have never been greater for us in the field. Think about it: a shrinking supply of agents and advisors, a growing population that needs and wants our guaranteed products, and an industry that will not go away. Simply put, we think we have some answers. But, we need to speak with you to find out what you want to accomplish, to analyze your speed bumps, and put together a plan. I guess you would say that we want to collaborate. Want to give it a try? Give us a call or simply click below to set up an appointment with one of our Marketing Consultants. I think the time is right. Until next time... good selling! |

Archives

April 2024

Categories |

Search Our Website to Find More Info, Tips, and Sales IdeasContact InformationOffice Address:

11611 N. Meridian Street | Ste 110 | Carmel, IN 46032 Phone: 1-877-844-0900 Fax: 317-844-4422 |

Quick Links |

THIS WEBSITE IS INTENDED FOR AGENT USE ONLY. NOT FOR USE BY CONSUMERS.

INFORMATION CONCERNING COPYRIGHT INFRINGEMENT CLAIMS

The Ohlson Group, Inc. provides links from its website to various third party sites which may enable you to obtain locations and information outside of The Ohlson Group's control. The Ohlson Group, Inc. neither controls nor endorses such other websites, nor have we reviewed or approved any content appearing on them. The Ohlson Group, Inc. does not assume any responsibility or liability for any materials available at these websites, or for the completeness, availability, accuracy, legality or decency of these sites.

CLAIMS OF COPYRIGHT INFRINGEMENT

The Digital Millennium Copyright Act of 1998, as amended, (the "DMCA") provides recourse for copyright owners who believe that material appearing on the Internet infringes their rights under U.S. copyright law. If you believe in good faith that materials we host infringe your copyright, you (or your agent) may send us a notice requesting that we remove the material or block access to it. If you believe in good faith that someone has wrongly filed a notice of copyright infringement against you, the DMCA permits you to send us a counter-notice. Notices and counter-notices must meet the then-current statutory requirements imposed by the DMCA; see http://www.loc.gov/copyright/ for details. Notices and counter-notices should be sent to info@ohlsongroup.com. The Ohlson Group, Inc., (877) 844-0900. We suggest that you consult your legal advisor before filing a notice or counter-notice. Also, please be aware that there are penalties for false claims under the DMCA.

The Ohlson Group Inc, and or Joseph R. Ohlson LUTCF is licensed to do business in all states except New York.

Privacy Policy

INFORMATION CONCERNING COPYRIGHT INFRINGEMENT CLAIMS

The Ohlson Group, Inc. provides links from its website to various third party sites which may enable you to obtain locations and information outside of The Ohlson Group's control. The Ohlson Group, Inc. neither controls nor endorses such other websites, nor have we reviewed or approved any content appearing on them. The Ohlson Group, Inc. does not assume any responsibility or liability for any materials available at these websites, or for the completeness, availability, accuracy, legality or decency of these sites.

CLAIMS OF COPYRIGHT INFRINGEMENT

The Digital Millennium Copyright Act of 1998, as amended, (the "DMCA") provides recourse for copyright owners who believe that material appearing on the Internet infringes their rights under U.S. copyright law. If you believe in good faith that materials we host infringe your copyright, you (or your agent) may send us a notice requesting that we remove the material or block access to it. If you believe in good faith that someone has wrongly filed a notice of copyright infringement against you, the DMCA permits you to send us a counter-notice. Notices and counter-notices must meet the then-current statutory requirements imposed by the DMCA; see http://www.loc.gov/copyright/ for details. Notices and counter-notices should be sent to info@ohlsongroup.com. The Ohlson Group, Inc., (877) 844-0900. We suggest that you consult your legal advisor before filing a notice or counter-notice. Also, please be aware that there are penalties for false claims under the DMCA.

The Ohlson Group Inc, and or Joseph R. Ohlson LUTCF is licensed to do business in all states except New York.

Privacy Policy

Copyright © 2024 The Ohlson Group, Inc. All Right Reserved.

RSS Feed

RSS Feed